How to Start a Business: A Step-by-Step Guide

- Dennis Bingham

- Apr 20, 2024

- 19 min read

Updated: Nov 13, 2024

Starting a small business is the American dream. And as appealing as it sounds, it takes heavy lifting to make it happen - from initial planning to handling ongoing marketing, finance, and legal needs.

The good news? By understanding the standard process successful entrepreneurs follow, you can stack the odds for your new venture in your favor.

Whether opening a retail storefront, starting a freelance or consulting business from your laptop, launching a product startup, or buying an existing small business, these best practices will set you up for success.

So, grab a coffee and get down to small business brass tacks.

Learn More>

PEW Research: A Look at Small Businesses in the U.S.

Prelaunch - Verifying Your Business Idea

Before investing serious time and money into a new venture, validating your offering matches a real market need is critical. Due diligence can save effort on products or services no one truly wants or would realistically pay for.

Start by extensively researching the target market and competitive landscape.

Seek unbiased feedback from potential customers through surveys and interviews to assess interests and preferences.

Hold a focus group to evaluate reactions to your product or service.

Make a competitive analysis evaluating similar companies' pricing, features, strengths, and weaknesses.

Create basic prototypes or mock-ups to demonstrate your concept.

This research will help answer the following questions:

Is there a need for your product or service?

What is your value proposition?

Who is your target customer?

Who are your competitors?

This feasibility research may require some financial investment - but far less than the cost of failure later. If the data looks promising, the green light to proceed with your small business idea gets brighter.

Researching your business idea involves gathering, analyzing, and evaluating information to help you write your business goals.

Prelaunch - Are You Ready to Start a Business?

Beyond a strong concept, starting a business requires an honest personal inventory regarding your abilities.

Most entrepreneurs pour sweat equity into their startups through self-financing and wearing many hats - especially in the early days. Before leaping, assess strengths and weaknesses related to business fundamentals like:

Management - can you juggle HR, vendors, and operations?

Marketing - what's your digital savvy and content creation ability?

Finance - how strong are your accounting and number-crunching skills?

Legal - do you understand contracts, liability, and trademarks?

Industry-specific - what direct experience do you have?

Fundamental knowledge in crucial entrepreneurship areas is vital even for founders with industry experience.

Reading books, eBooks, and blogs, listening to podcasts, and taking relevant online courses in business planning, marketing, financing, operations, etc., can supplement one's skillset.

It's also vital to prepare for risk and unpredictability. Entrepreneurship can be a rollercoaster - make sure you have the stomach for it.

Bringing on co-founders or early team members with complementary skills can counterbalance areas one needs to improve personally, such as technical execution, operations, industry expertise, etc.

Beyond relying on personal savings, financing options include small business loans, grants, angel investors, venture capital, and crowdfunding campaigns.

Gaining additional knowledge, building a balanced team, understanding the risks involved, and pursuing multiple financing avenues will help determine if one has the resources and risk tolerance to move forward.

Reaching out early on to mentors like SCORE volunteers or experienced entrepreneurs can also provide invaluable guidance on weaknesses to improve beforehand or ideas with potential.

With honest self-evaluation and addressing gaps, you'll be primed for the demanding adventure of small business ownership.

Learn More>

Launch - What Are the Eight Steps to Starting a Business?

The eight steps to start a business are:

Let's take a closer look at each of these steps.

Step 1: Write a Business Plan

A well-crafted business plan is essential for outlining your company's mission, vision, target market, and strategies for success.

It helps you define your goals, identify your target audience, understand your competition, and establish a roadmap for achieving your objectives.

There are three types of business plans: a comprehensive plan, a mini-plan, and a one-page business plan.

Comprehensive Business Plan

Here is a high-level overview of what a comprehensive business plan entails:

Executive Summary

A 1–2-page summary covers the critical details of the business, its objectives, ownership team, target market, competitive advantages, financial outlook, and funding needs.

Company Description

This section provides an overview of the venture's history, operations, location, legal structure, leadership team, number of employees, and growth trajectory.

Market Analysis

Research and analysis on the overall market size, trends, growth potential, customer segments, and the competitive landscape. Details the target customer profile.

Products/Services

A description of the company's core products or services, highlighting features and benefits, proprietary elements, and the product roadmap/release schedule.

Marketing Plan

Strategies and tactical plans for promoting products/services to customers include branding, pricing, sales channels, partnerships, advertising, and other customer acquisition/retention tactics.

Operations Plan

This section details how the business functions daily, including business processes, technology, digital assets, supply chains, and legal regulatory issues.

Management Team

Profiles key company personnel, summarizing their responsibilities, experiences, qualifications, and achievements. Emphasizes what equips this team to execute the venture's plans.

Financial Plan

Historical and projected financial statements, including income statements, balance sheets, and cash flow statements. Details critical revenue and cost drivers, burn rates, and profitability timelines.

Funding Requirements

Specifies the capital needed to launch and scale operational plans successfully. Describing specific uses and timing for funds and financing options would be best.

That covers the core components of a comprehensive business plan.

One-Page Business Plan

I recommend you start with a 1-page business plan and use that as a basis for one of the other plans, if necessary.

Below is an example of a one-page business plan.

A one-page business plan is a simplified and condensed version of a traditional business plan focusing on the critical elements needed to succeed in a business venture.

A one-page business plan has numerous benefits. It helps entrepreneurs quickly and easily communicate their business strategy to stakeholders, including potential investors, partners, and employees.

Learn More>

When writing your plan, it is crucial to consider the five Ps of marketing: Product, Price, Promotion, Place, and People.

These elements help you shape your marketing strategy and effectively reach your target customers.

Consider questions like:

What unique value does your product or service offer?

Who are your competitors?

How will you price it?

How will you promote and advertise your business?

Where and how will you sell your products?

And finally, who are the key individuals involved in your business's success?

One-Page Marketing Plan

As part of broader planning, devise a one-page marketing plan covering unique value propositions, target customers, positioning against competitors, and platform strategies across areas like:

Website

SEO

Email marketing

Social media

Advertising channels

Concisely plotting marketing and sales approaches saves haphazard efforts down the road.

SWOT Analysis

Finally, a SWOT analysis identifies strengths, weaknesses, opportunities, and threats influencing the viability of your concept:

Strengths - What resources or capabilities give you an edge?

Weaknesses - What gaps or shortcomings need addressing?

Opportunities - What external factors could you capitalize on?

Threats - What hurdles or competition could undermine success?

Below is an example of a SWOT analysis.

This assessment allows strategically leveraging assets while confronting real-world roadblocks.

The business planning process sets the stage for the demanding entrepreneurship journey ahead. However, a business plan can make it easier to complete these foundational steps.

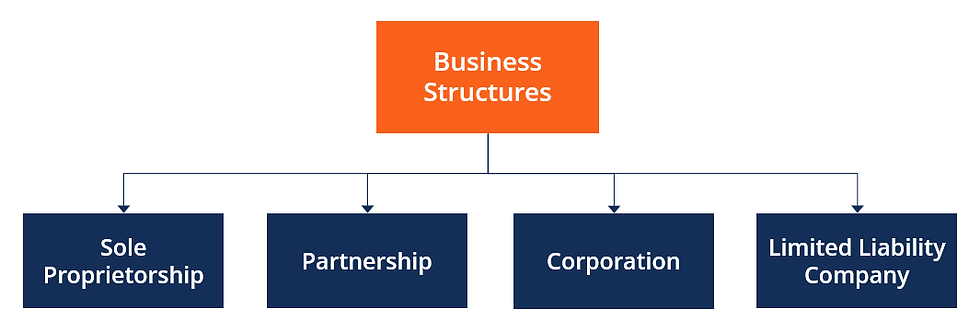

Step 2: Form Your Business

The second step in starting a business is determining the legal structure that best suits your needs. Standard options include sole proprietorship, partnership, corporation, and limited liability company.

Sole Proprietorship

A sole proprietorship is the simplest and most common form of business structure. It is a business owned and operated by a single individual without legal separation between the owner and the business.

From a tax perspective, the income and expenses of the business are included in the owner's tax return.

Here are its pros and cons:

Pros:

Ease of Formation: Establishing a sole proprietorship is relatively easy, with minimal legal formalities and paperwork.

Control: The owner controls the business, including decision-making and operations.

Taxes: Tax reporting is straightforward, as business income and expenses are reported on the owner's tax return.

Cons:

Unlimited Liability: The owner is liable for all business debts and obligations.

Limited Growth Potential: Due to limited resources, sole proprietorships face many challenges in accessing financing and expanding their businesses.

Lack of Continuity: The business does not survive the owner, making it challenging to transfer ownership.

You should evaluate the pros and cons of each business structure you are considering. This type of analysis will help ensure you are making a well-reasoned decision.

Partnership

A partnership is a business structure owned by two or more partners who share management responsibilities and profits or losses.

Partnerships are relatively easy to form through partnership agreements, requiring less paperwork than incorporation. They also benefit from pass-through taxation, where profits and losses flow to the partners' personal tax returns, avoiding double taxation.

However, partners have unlimited personal liability for debts and legal issues arising from the business. If the partnership dissolves, this can trigger major disruptions in operations.

Partnerships also have less access to financing since they cannot sell equity shares like a corporation.

Careful planning is needed to establish decision-making authority, responsibilities, profit-sharing, and buyout terms through a partnership agreement.

Corporation

Corporations are independent legal entities from their owners, which makes them more complex to form and administer.

Ownership is easily transferable through selling shares of stock. Corporate profits are taxed as dividends at both the corporate and shareholder levels.

Corporations offer the strongest liability protection to shareholders for company debts and legal judgments.

The perpetual existence of corporations and centralized management structures provide more sustainability. Corporations can raise large amounts of capital essential for growth by issuing stock - which is critical for expanding startup ventures.

However, extensive corporate recordkeeping and reporting requirements come with that fundraising flexibility.

Overall, the corporate structure supports large-scale entities but involves more upfront investments of time and money during the incorporation process and ongoing compliance administration.

Limited Liability Company

LLCs are the youngest business structure type in most states. They combine the benefits of partnerships, corporations, and sole proprietorships.

Like partnerships, profits pass through to owners who pay taxes at personal rates while avoiding double taxation. The key advantage is LLC owners have limited personal liability for business debts and legal issues.

LLCs afford greater flexibility in structuring management and governance compared to corporations. However, LLCs receive less favorable tax treatment regarding employee benefits and reasonable compensation than corporations.

Establishing an LLC is more complex than a sole proprietorship but more straightforward than incorporating.

The operating agreement establishes financial and management relations between members. Some lenders perceive LLCs as less credible borrowers than corporations, making financing more challenging.

Overall, LLCs offer liability protections with partnership taxation flexibility.

Learn More>

Bonus Alternative: Nonprofit

Nonprofits fulfill religious, charitable, scientific, literary, educational, or other socially valuable purposes rather than commercial activities.

Nonprofits offer donors tax deductions for their financial gifts. Many foundations and government agencies provide grants to nonprofit programs serving community needs.

Nonprofits themselves are exempt from certain federal, state, and local taxes. Volunteers often donate their time supporting nonprofit missions they deeply care about.

However, nonprofits cannot distribute net earnings to members or executives. Their reliance on grants and donations leads to less financial stability in the long term.

Nonprofits must comply with extensive recordkeeping and annual reporting to maintain tax-exempt status or risk paying back taxes and penalties. The nonprofit structure works for organizations focused on social contribution over making profits.

Summary - Form Your Business

Legal and tax guidance is essential in choosing and establishing the best structure to achieve each business's strategic goals. Forming relationships with qualified attorneys and CPAs saves money in the long run.

Step 3: Register Your Business

Once you have written your business plan and determined your business structure, you must register your business with the appropriate state and federal government authorities.

Business Name

Before registering, you must ensure your business name is unique and doesn't infringe on existing trademarks.

Thoroughly vet your namesake to avoid infringement on existing trademarks and ensure web domain availability. Check the Secretary of State databases and the USPTO's TESS system.

Learn More>

Employee Identification Number (EIN)

For tax and employment purposes, apply for free Employer Identification Numbers reflecting new entities from the IRS.

While obtaining an Employee Identification Number is primarily a federal task via the IRS, some states also require state tax ID numbers for certain businesses. Check your state requirements on the Department of Revenue or Taxation website.

State Tax ID Numbers

Collecting sales tax requires registering for state tax IDs after determining nexus thresholds. Skip this step if selling digital products without a physical presence.

Licenses & Permits

Many businesses require state-issued permits or licenses to operate legally. These may include professional licenses, sales tax licenses, and health permits. The exact requirements vary by state, industry, and the specific nature of your business.

To ensure compliance, familiarize yourself with the regulations in your jurisdiction. Non-compliance triggers hefty fines.

Website

You should also register your website domain name. This is the first step toward branding your business.

Step 4: Prepare Your Finances

After the legalities and formalities are completed, the following steps are assessing the financial realities, securing funding, and setting up systems for ongoing finances.

Skipping this step courts disaster through incorrect budgeting, cash shortfalls, or accounting mismanagement.

Separate Business Accounts

Commingling personal and business funds can distort the understanding of profitability while complicating tax filings and strategic decisions. Open dedicated checking/savings accounts earmarked explicitly for your venture.

Project Capital Requirements

Many startups fail because of undercapitalization. Be ruthlessly realistic in projections for upfront costs like equipment, product development, facility leases, and prelaunch marketing. Additionally, budget for several months of operating expenses pre-revenue.

Explore Funding Sources

With accurate capital requirements mapped, examine financing options like small business loans or lines of credit, crowdsourced fundraising, angel investments, or VC backing if poised for fast growth.

Weigh rates/terms, giving up equity stakes and repayment concerns when selecting the best sources.

When starting a business, securing sufficient capital is essential.

Beyond savings or credit cards, external funding sources include:

Revenue-Based Financing

Revenue-based financing provides funding in exchange for a fixed percentage of future revenue over a set period, usually between 6 months to 3 years.

SBA Loans

The SBA offers various low-interest loan programs to assist early-stage ventures, covering costs like equipment purchases and working capital. SBA-backed loans provide appealing rates/terms versus alternatives.

Equipment Financing

Equipment financing allows small businesses to secure funding quickly to purchase essential equipment like machinery, vehicles, and technical systems.

Invoice Factoring

Invoice factoring gives businesses access to capital based on the value of their unpaid customer invoices.

Crowdfunding

Platforms like Kickstarter, Indiegogo, and GoFundMe let entrepreneurs raise smaller chunks of funds from a large donor pool through campaigns with donor rewards.

Merchant Cash Advances

Merchant cash advances provide quick access to a lump sum of capital in exchange for a fixed percentage of a business's future credit card sales.

Peer-to-Peer Lending

Peer-to-peer lending connects business borrowers directly with individual lenders via online platforms. This enables access to loans from individual investors rather than financial institutions.

Angel Investors

Wealthy individuals provide financing to startups in exchange for equity or convertible debt. It is best for innovative, scalable companies since angels seek sizable ROI potential.

The optimal funding mix reduces personal liability while securing enough operating capital until profitability.

Grants

Grants provide small businesses with funds that don't need to be repaid. Many government agencies, nonprofit foundations, corporations, and more offer grants.

Accounting Software

Cloud accounting systems like Quickbooks or Xero provide easy invoicing, payroll, tax preparations, inventory management, and other financial oversight essentials for tight control as you scale.

Link bank/credit accounts for automated syncing to simplify bookkeeping.

Core Financial Statements

In tandem with accounting software, diligently preparing three key financial statements provides real-time performance visibility leveraged to guide decisions:

Income Statement - This monthly profit and loss statement subtracts operating expenses from sales revenue to reveal net earnings over a period. Monitor trends to adjust high-cost areas.

Balance Sheet – A snapshot of assets like cash reserves and property owned, balancing against what your business owes creditors. The balance sheet indicates whether you have a capital cushion.

Cash Flow Statement – Tracks monthly inflows and outflows of cash tied to business activities—early warnings against potential cash crunches.

While financial paperwork can initially be intimidating, consistent financial reporting discipline pays dividends for monitoring current health and supporting future funding needs.

Over time, reading key performance indicators and ratios derived from financial statements becomes second nature.

Ongoing Cash Flow Monitoring

Pay close attention to cash inflows and outflows through diligent financial recordkeeping. While profitable on paper, many ventures fail because of insufficient cash flow to cover payroll and monthly expenses.

Adherence to sound financial practices is as important as product or service quality for success in small business.

Learn More>

Step 5: Protect Your Business

While not glitzy, obtaining adequate commercial insurance shields against unexpected catastrophes threatening to derail smooth operations. Identify specific policies providing essential protections:

For example, a slip-and-fall accident can cost as much as $15,000 to $20,000. Without business insurance, you may have to pay for costly damages and legal claims against your business.

General Liability Insurance

Slips and falls or professional mistakes could expose your business to expensive legal judgments. General liability insurance covers payouts from bodily injuries, property damage, and related legal defense fees from third-party claims. It is also called CGL, public liability, or business liability insurance.

Professional Liability Insurance

Professional liability coverage for ventures offering skilled services like IT consultants, marketing agencies, or healthcare providers handles damages from potential errors and omissions. Professional liability insurance is also termed errors and omissions (E&O) insurance.

Product Liability Insurance

Manufacturers face extensive risks tied to product safety - even if issues originate from 3rd party suppliers further upstream. Guarantee quality control while mitigating dangers through sufficient product liability insurance.

Cyber Insurance

Cyber-attack threats pose growing concerns for online businesses. Consider cyber insurance to protect your business against data breaches, hacking incidents, or malware crises, including legal costs, settlement payouts, and restoring digital assets or reputation.

Step 6: Start Operations

The launch process transforms an idea into an operating business. Meticulous preparation across key areas reduces snafus as you open doors.

Perfect Your Offering

Revisit competitive differentiation, ensuring your product/service and positioning speak to target customer needs through a unique value proposition. Refine based on beta tester feedback addressing concerns.

Select a Business Location

Choosing the right location is one of the most important decisions when starting a business. The location can have a significant influence on many factors that impact the potential success and profitability of the business. Key considerations when selecting a business location include:

Customer proximity and accessibility - Consider who your target customers are and choose a location that allows convenient access and high visibility to that customer base. Foot traffic and drive-by traffic should be assessed.

Competition - Research competitive businesses already operating in potential locations. Selecting a location near competitors can help draw similar customers, but more competition in the same area can also be beneficial.

Costs - Expenses like rent, utilities, taxes, and insurance can vary significantly by area and must be aligned with budget limitations. Also, the costs of complying with zoning regulations in different locations must be considered.

Labor market – Easy access to a skilled workforce is essential unless the business requires little staffing. Proximity in targeting employees' residences can help attract and retain talent.

In addition to these main factors, business owners must consider parking availability, supply chain logistics, incentive programs, and growth potential based on their specific business type and industry.

Evaluating all location options against critical success factors will help entrepreneurs select the best location for their business venture, giving it the highest chance of prospering.

Learn More>

Build a Team

Hire passionate, skillful teams aligned to company culture capable of fulfilling duties across customer service, sales, marketing, IT, and finance. Outline detailed job descriptions, incentives, workflows between departments, and KPIs.

As scaling validates market traction, bringing on talent expands capacity:

Employees

Vet and onboard W-2 employees for long-term core team roles managing operations.

Freelancers

Leverage specialized independent talent for projects or temporary bandwidth.

Strategic Partnerships

Formalize win-win relationships with other firms to share customers or resources.

Delegation to competent team members, contractors, and partners allows founders to focus on high-level growth.

Create Operational Blueprints

Document step-by-step protocols guiding essential functions like order/request intake methods, fulfillment/delivery workflows, customer service interactions, product quality control, and general decision authority hierarchies between teams.

Open Communication Channels

To keep customers informed, facilitate timely information sharing through internal methods like team messaging platforms and external channels such as email newsletters or text updates.

Financial Monitoring

Using accounting software, watch sales funnels, profit margins, and cash reserves like a hawk. Build financial models projecting growth trajectories based on market conditions.

Optimize Accordingly

Solicit ongoing customer feedback about their experience while empowering employees to suggest process improvements. Refine policies that balance quality, cost, and convenience.

With diligent upfront preparation, the launch phase sets the trajectory for sustainable business success over the long term. Stay nimble and keep optimizing.

Manage Your Suppliers

The adage "a chain is only as strong as its weakest link" also applies to small business supply chains. Diligently vetting and then actively managing relationships with vendors providing your inventory, materials, or services ensures consistency in meeting customer needs.

Research Prospective Suppliers

Verify quality assurance track records.

Compare pricing tiers based on order volumes.

Examine typical lead and shipping times.

Check out online reviews and complaints.

Optimally validate offerings firsthand through samples to tangibly assess durability, consistency, and accuracy in fulfilling your required specifications.

Formalize Agreements

Once confident in suppliers' capacity to deliver, formalize long-term agreements outlining:

Pricing formulas based on scales of monthly volume

Ideal transportation modes and accounts

Customization capabilities and associated fees

Payment/billing procedures and terms

Clear terms set expectations while preventing assumption gaps or surprises

Monitor and Provide Feedback

Stay engaged post-contract through:

Random spot inspections maintain quality

Tracking delivery times and inventory levels

Providing usage data to refine projections

Relaying customer feedback on products

Cultivating receptive, communicative relationships with suppliers gives you influence, allowing renegotiation if their performance declines over time. By keeping your ears to the ground, you can quickly resolve hiccups.

A reliable supply chain safety net reduces unpredictable disruptions undermining sales and revenue vital for staying power.

Step 7: Marketing Your Business

Marketing and promotion make or break visibility. With limitless digital options today, disciplined efforts playing to your strengths are critical.

Communicate with Customers

Send email newsletters covering company updates, product launches, special promotions, etc.

Conduct surveys to gauge customer satisfaction and improvement areas.

Create loyalty programs with points, rewards, and early access to new arrivals.

Offer referral rewards to encourage existing buyers to recommend you.

Quality engagement shows you value relationships beyond transactions.

Set Up a Functional Website

Today, a website is mandatory - establishing your digital flagship as either:

Informational Site - For service providers like contractors or consultants, website pages detail offerings, expertise, work samples, bios, and contact forms showing professionalism.

E-commerce Store - Retailers sell directly online through beautiful visual catalogs, simplified checkouts, and clear shipping/returns policies.

Ensure fast load speeds, mobile responsiveness, SEO optimizations, and security protections. Provide new visitor incentives.

Establish Brand Recognition

Consistency in logos, color schemes, fonts, and messaging builds familiarity. Integrate visual identity widely across:

Business cards

Product packaging

Storefronts/Offices

Staff uniforms

Website and ads

Adapt and localize branding when expanding into new markets while retaining core elements.

Execute a Social Media Strategy

Promoting on critical platforms like Instagram, Facebook, and LinkedIn allows discovering and engaging ideal new buyers through:

Content Marketing - Show expertise by educating followers with valuable posts or short videos.

Paid Ads - Highly target interest-based demographics with campaigns optimized for conversions.

Hashtag Marketing - Identify and incorporate trending hashtags, topics, and challenges relevant to your industry.

Monitor analytics on posts and allocate monthly paid advertising per click/conversion metrics.

Consider Going Online

The internet dramatically expanded small business possibilities, allowing businesses to serve a global market digitally across time zones from anywhere.

With remarkably low barriers to entry today, taking at least part of your business online deserves strong consideration.

Flexible location - Work remotely from home or establish a small home office. Reduce expensive leased commercial space overheads.

Low startup costs - An internet business requires little more than a laptop, WIFI, website, marketing, and shipping accounts/tools—bootstrap friendlier path vs high-capital equipment or retail buildout.

Wider reach - Promote local audiences or sell to anyone with WIFI worldwide through social platforms and digital ads.

Passive income - Create a recurring revenue stream through membership sites, online courses, eBooks, virtual services, or automation.

Metrics tracking - The digital landscape eases gathering visitor and buying behavior analytics for data-driven efforts.

Conventional physical goods businesses benefit immensely from robust websites, social media ads, and search engine visibility.

Ensure your website foundation facilitates possible future expansion into online sales should you decide to augment profit drivers down the road.

Creativity, remote work's flexibility, and global 24/7 exposure empower turning side hustles into full-time ventures.

What could you offer digitally?

Step 8: File and Pay Taxes

The tax obligations tied to owning and operating a successful business are complex - but non-compliance invites massive penalties or garnished revenues from unpaid dues.

Integrating diligent tax planning helps minimize liability.

Federal Tax Requirements

The IRS mandates payments for estimated quarterly income taxes, payroll withholding for W-2 employees, and related tax returns.

New businesses often opt for S-Corp election or LLC tax classification to reduce self-employment tax burdens.

State & Local Taxes

State and city governments also levy corporate income, sales and use, and specialized industry-specific taxes. Staying current on filing thresholds is especially important for eCommerce outlets amidst shifting nexus rulings.

Choose a CPA Strategically

While tempting to save on costs, a dedicated small business CPA adds tremendous value, assisting with initial tax strategy, staying current on state and federal compliance, maximizing write-offs and deductions, and fighting any audit inquiries.

The investment pays compliance dividends.

Tax-Advantaged Business Structures

Certain entities offer inherent tax advantages. For example, certified B Corporations focused on environmental/social impact and Qualified Opportunity Zone funds promote community development and better optimize taxes.

Tax obligations keep growing more complex annually - getting expert assistance prevents missteps as your business scales.

Learn More>

Additional Considerations

While the eight steps we've covered create a strong foundation, a few additional areas warrant mention for anyone embarking on the small business journey.

Choose Technology Wisely

Today's affordable SaaS solutions eliminate hardware headaches with streamlined options for most administrative tasks, such as payroll, project collaboration, invoice, and inventory management.

Thoroughly evaluate new tools with free trials before committing to avoid feature bloat or recurring fees eroding bootstrap budgets over time.

Modern SaaS platforms streamline critical functional areas:

Accounting - QuickBooks, Freshbooks

CRM - Salesforce, HubSpot

Payments - Stripe, Square

Email Marketing - MailChimp, Constant Contact

Project Management - Asana, Trello

E-Commerce - Shopify, Wix

Integrating the right tech stack saves substantial administrative headaches as a business grows.

Build An Advisory Team

Identify key outside experts who can provide trusted guidance as your business grows.

An experienced lawyer, accountant, insurance agent, finance expert, and industry-specific veteran make valuable advisory board members to bounce ideas off or leverage connections.

A few hours monthly prevent costly missteps.

Consider Outsourcing Help

Acknowledge personal limitations - entrepreneurs wearing every business hat often stretch themselves too thin.

Leverage outsourced assistants for everything from virtual receptionists to IT support, bookkeeping, and digital marketing assistance during bootstrapping stages.

Delegate non-core functions until full-time specialists are ready to be added.

Preparing Contingency Plans

Despite best efforts, unanticipated events can quickly unravel growth.

Develop emergency contingencies for scenarios like natural disasters halting operations, massive product defects, or technology outages cutting off customers.

Insurance helps, but documented incident response plans speed recovery.

Frequently Asked Questions

Q: Can I work a regular job while launching a new business?

A: Absolutely. Part-time entrepreneurship, especially for brick-and-mortar companies, lets you get started while preserving a paycheck. Set realistic deadlines that align with resource availability.

Q: What business should I start as a beginner?

A: Start where your experience lies. Leveraging existing skills or completing additional education in known industries boosts odds through competence advantage.

Q: How long does starting a business take?

A: The average incorporation timeline runs 6-12 months from validating concepts through prelaunch prep work before welcoming first customers through the doors or online.

However, some basic one-person consultancies take mere weeks, while manufacturing operations may take 1-2 years to prepare for distribution demands at scale.

Q: What percentage of new businesses fail?

A: Per the Bureau of Labor Statistics, approximately 20% of small businesses fail within the first year. However, by year five, that number grows to 50%.

Proper planning prevents many downfalls.

Q: Should I take out business loans or self-fund?

A: If your personal savings can fully cover business launch costs without impacting living expenses, bootstrapping is preferred to avoid finance charges or giving up company equity to investors.

However, if startup costs exceed personal capital, consider low-interest SBA microloans up to $50K that help bridge funding gaps. Payments stay manageable as revenue starts flowing.

The key considerations are minimizing risk or overextending personal finances, which are critical for rent/mortgages. SBA backing keeps loan rates affordable.

Conclusion & Next Steps

That wraps up our start-to-finish blueprint, which covers significant steps for entrepreneurs who aspire to turn business ideas into thriving companies!

By following a systematic approach, securing proper advisors, and staying nimble to pivot along the way, your chances of success accelerate tremendously. Avoid skipping corners and build a resilient foundation primed for growth.

Additional Resources

Thank you for reading this article on How to Start a Business. We recommend these additional articles related to starting a business.

Learn More>

コメント