Legal Essentials for Small Business Owners: A Comprehensive Guide

- Dennis Bingham

- Jun 27, 2024

- 13 min read

Updated: Nov 14, 2024

Starting your own small business is an exciting adventure - one minute, you're dreaming up the perfect product or service; the next, you're staring down a mountain of legal paperwork.

As an entrepreneur, your brain is already overflowing with big ideas, marketing plans, and the gastrointestinal repercussions of living on ramen noodles. Adding a "legal expert" to your job description can feel like one responsibility too many.

But here's the thing: getting the legal stuff right from the get-go can save you a world of headaches and heartaches. Ensuring you cross those legal t's and dot those i's isn't just about covering your bases. It's about building a solid foundation that will allow your biz to take off.

That's why I've put together this comprehensive guide. We'll discuss everything from choosing the right business structure (trust me; it matters!) to protecting your ideas, navigating employment laws, and ensuring you stay financially on Uncle Sam's good side.

So, buckle up, and let's get started! The legal roller coaster awaits.

Section 2: Choosing the Right Business Structure

Okay, Let's Talk Business Structures - Where Do I Even Start?

As an excited new business owner, you're probably dreaming big about your brand, products, marketing, and other exciting aspects of your business.

But then reality hits - you must figure out how to legally structure this thing. Trust me; I get it. Reading up on sole proprietorships and LLCs is as exciting as doing taxes.

But hear me out because how you structure your business isn't just an administrative box to check. It will shape the trajectory of your entrepreneurial journey. Are you ready to go all in alone and put your assets on the line? Or do you want to limit your liability exposure from the get-go? Decisions, decisions.

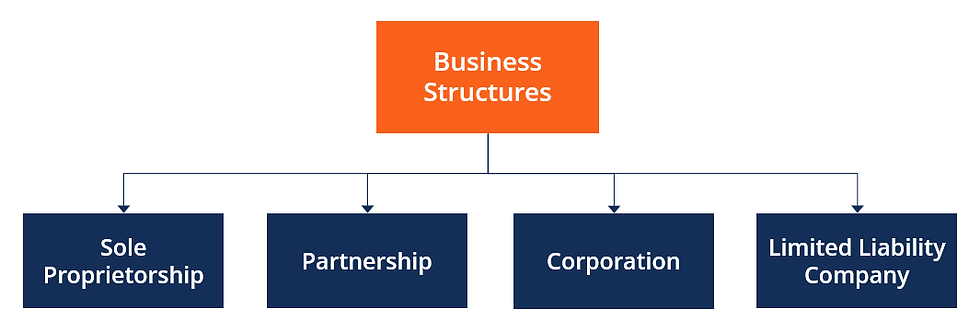

The Four Main Players: Which One Is Right for You?

Let's break down the four main business structures simply:

Sole Proprietorship - Streamlined and easy but risky. You are the business, so any issues, debts, or lawsuits directed at your company become yours.

Partnership—Sharing is caring! You enter into business with other owners and share profits, liability, and management duties based on your agreement.

LLC - This popular kid on the block gives you liability protection while still allowing flexible tax perks and management—an excellent middle ground for many small businesses.

Corporation - The big boss structure with maximum liability coverage but more compliance hoops. This structure is best for more prominent companies looking to raise funds.

Weighing the Pros and Cons of Your Unique Situation

Here's the thing - there's no one-size-fits-all perfect business structure. The right one for you depends on critical factors like:

Solo mission or partners in crime?

How much risk you can stomach in terms of liability

Your growth plans and funding goals

Balancing admin/compliance workload with taxes

It's a highly personal decision that can make or break you, so don't just follow the herd. Think it through while the stakes are still low.

And remember, you're not married to your initial structure forever. As your business evolves and goals change, pivot to something else if needed. The key is understanding all your options from the start.

Section 3: Registering Your Business

So, You've Picked a Business Structure, Now What? Time to Make It Official!

Choosing the right structure for your small business has tackled one of the most significant legal hurdles and is nicely done! But wait to break out the celebratory beverages. Some essential registration and paperwork hurdles still need to be cleared.

Registering Your Business at the State Level

Depending on where your business is located and what structure you choose, you'll likely need to register with your state government. This process helps legalize your business and operations.

You may need to register your business name and secure the proper licenses/permits for sole proprietorships and partnerships. LLCs must file Articles of Organization, while corporations file Articles of Incorporation.

State fees and requirements vary, so check with your Secretary of State's website. You may also need to publish a notice of incorporation in your local newspaper (glamorous, right?).

Don't Forget About Licenses, Permits, and Tax IDs

Part of getting legit as a business is ensuring you have all the proper licenses and permits. Common ones include professional/occupational licenses, sales tax permits, and zoning/building permits.

You'll also need an Employer Identification Number (EIN) from the IRS, even if you don't have employees yet. Think of it as your business's social security number for tax purposes.

These licenses/registrations ensure you follow industry and location regulations. Failing to secure licenses and registrations could result in fines or even shutting down, so don't skip this crucial step!

Staying Compliant at the Local Level

Abiding by state laws and federal requirements isn't enough - you also need to ensure your business follows all relevant local ordinances. These can cover zoning regulations, building codes, signage rules, parking requirements, etc.

Do your research by checking with your city/county on any specific local licenses, fees, or restrictions that apply to your type of business and operations. You may need additional permits to operate legally within certain zoning areas.

Handling all this red tape upfront is a headache, but it protects your business and shows you're a responsible, law-abiding entrepreneur. So grab those license applications, and let's get properly registered!

Section 4: Understanding Contracts and Agreements

Why Small Businesses Can't Survive Without Contracts

As a small business owner, you'll inevitably enter into all sorts of agreements and business arrangements. But if they're not correctly documented and formalized, your company will be vulnerable to costly disputes and issues down the road.

The Bread-and-Butter Contracts All Small Businesses Need

While contract needs vary by industry and operations, some common must-have contracts include:

Client/Customer Contracts - These outline the scope of work, payment terms, intellectual property rights, and more when providing services or selling products. Get it in writing!

Vendor/Supplier Contracts—Formalize agreements to avoid misunderstandings later, whether you're sourcing inventory, freelancing help, or other B2B services.

Employment Contracts - Besides having an employee handbook, job contracts prevent issues by specifying job duties, compensation, non-competes, etc.

The Key Components of a Solid, Enforceable Contract

So, what makes a contract legally valid and enforceable? A few must-have elements:

Offer and Acceptance - An explicit agreement regarding the deal's terms must exist.

Consideration - Something of value must be exchanged, like services for money.

Legal Purpose - The subject matter can't involve anything illegal or go against public policy.

Capacity - All parties must be legally able to enter into the contract.

Tips for Effortless Contract Management

Drawing up airtight contracts doesn't have to be an uphill battle:

Keep them clear and concise, avoiding legalese

Ensure all terms are fair and agreeable to all parties

Specify resolutions for potential conflicts or breaches

Have an attorney review anything complex

Use contract software to streamline everything

The modest effort of formalizing agreements through contracts pays dividends by resolving issues before they become expensive legal nightmares.

Section 5: Protecting Intellectual Property

Don't Let Your Million Dollar Idea Get Stolen - Secure Your IP!

As a small business owner, your intellectual property (IP), such as branding, products, and processes, maybe your most competitive advantage. But do you know how to protect and leverage those valuable assets fully?

The Four Main Forms of Intellectual Property Protection

Trademarks - Covers brand names, logos, slogans, or any "source identifiers" you use to distinguish your goods/services in the marketplace.

Copyrights - Protects your creative, original works like website content, marketing materials, graphics, music, etc.

Patents - Gives exclusive rights over new inventions or processes you've developed, like products or software.

Trade Secrets - Covers confidential information that gives you a competitive edge, like proprietary formulas, data, etc.

Key Steps to Safeguard Your IP

Simply having IP doesn't protect it - you need to be proactive:

Do your homework - Conduct trademark/patent searches before branding or launching products.

File for protection - Register trademarks, patents, and copyrights with the proper authorities.

Use proper markings - Like the ® ™ © symbols to put the world on notice.

Restrict access - Only allow trusted parties to view trade secrets under confidentiality agreements.

Monitor aggressively - Watch for infringers and pursue violations through lawsuits if needed.

The High Cost of IP Oversight

Your IP may be intangible, but the hit you take if infringed upon is too tangible.

We're discussing lost revenue, destroyed brand reputation, and expensive litigation costs. An ounce of prevention through proper IP protection is worth every penny!

Section 6: Compliance with Employment Laws

So, do you want to be an employing entrepreneur? Not So Fast, Friend

As a fresh-faced entrepreneurial upstart, that first hire is a big deal. You're not just bringing on an extra pair of hands - you're becoming an honest-to-goodness employer. And with great power comes great responsibility toward employment laws.

The Legislation Keeping Your Office Legit

Imagine an office free-for-all with zero standards for pay, ridiculous overtime demands, and negligent safety practices. Pretty dystopian, right? That's why these big-name laws exist:

The Fair Labor Standards Act (FLSA) - The OG workplace rules put minimums on wages, maxes on hours, and a hard pass on child labor.

The Family and Medical Leave Act (FMLA) - Allows your team to take a break from medical situations or to grow their family without penalty.

The Americans with Disabilities Act (ADA) - Ensuring equal opportunities and prohibiting discrimination against stellar employees with disabilities.

The Name of the Hiring Game? Playing By the Rules

Hiring people may seem as simple as scrolling LinkedIn and picking personalities you vibe with. But there's a strict legal process involved, from posting that job to letting someone go:

Job Ads and Interviews - These are equal opportunity endeavors void of discrimination against race, gender, age, disabilities, or other protected classes.

New Hire Paperwork - Putting them on payroll isn't casual. I-9s must be completed, work eligibility documented, and the whole nine.

Employee Classification - Knowing when someone is legit full-time W-2 material versus an independent 1099 contractor is crucial.

Firing Protocols - Even terminations must be done precisely and without bias, or else lawsuits await.

Building a Legally Awesome Place to Work

Of course, compliantly employing people goes way beyond just paperwork. As a savvy entrepreneur, you'll want an employee-centric culture, too:

Detailed Employee Handbooks - Clearly documenting all workplace rules, PTO, procedures, and protocols.

Fair and Equitable Practices - A strict zero-tolerance policy on harassment, compensation discrimination, etc.

Staying OSHA Compliant - Putting worker safety first by following health and safety standards to a T.

Accurate Record Keeping - Tracking detailed data on hours worked, time off, incidents, etc.

Following employment laws isn't just about covering your assets. It's about prioritizing your team's well-being and rights as humans. Zig when others zag toward an exceptional workplace!

Section 7: Marketing Compliance

Your Ads Are Fire, But Are They Fanning the Flames of a Lawsuit?

These days, you have to shout from the rooftops to cut through the brand noise and promote your business. But watch yourself - certain marketing tactics could attract the wrong kind of attention from disgruntled customers and hungry lawyers.

The Legislating Lords of Advertising Truths

The world of marketing has its own undercover compliance police upholding some core rules of the road:

The FTC Act - Whose big mission is ensuring companies aren't deploying deceptive or unfair tactics to mislead consumers. No monkey business allowed.

The CAN-SPAM Act - Putting a leash on overzealous email marketing by requiring unsubscribe links, truthful subject lines, and more.

GDPR - Upholding data privacy and protection put in place by the European Union. You can't be cavalier with people's personal information.

TCPA - Having your team's back by restricting aggressive telemarketing outreach through calls and texts.

Plus, each state and industry has its own additional rules regarding claims, professional titles, disclosures, and other topics.

Rise Above and Market With Authenticity

What is the best piece of compliance advice? Just be a straight shooter in your promotions! Some smart tips:

Talk is Cheap - So Don't Underdeliver. Ensure your products, pricing, terms, and claims are 100% accurate from the start.

Disclose Disclose Disclose - Anything like incentivized sponsorships, disclaimers, or limitations need clear, conspicuous labeling.

Ask for Permission, Then Ask Again - Whether via email, snail mail, or text, get opt-in consent first to avoid spam traps.

Real Recognizes Real - Build credibility and trust by highlighting authentic customer reviews and results.

Stay Sizzling But With Substance

Getting loud and cheeky with your advertising is part of the hustle. The FTC wants you to start with a solid foundation of honesty and transparency. With some legal structure, you can get as creative as you please.

Section 8: Managing Taxes and Financial Obligations

Ah, Taxes, The Unstoppable Force That Even Superheroes Can't Avoid

As a small business owner, very few things are as certain as taxes. Whether you're a solo freelancer or you've got a whole team, Uncle Sam always wants his cut of the action.

The Tax Obligations You Can't Ignore

Thought taxes ended with filing your personal return each year? Not quite, my friend. Small businesses have additional tax responsibilities like:

Income Taxes - Whether you're structured as a corporation, partnership, or sole prop, you've got to pay taxes on your business income.

Self-Employment Taxes—If you're self-employed, you must pay the employer and employee portions of Medicare and Social Security.

Employment Taxes - With W-2 employees, you must withhold and pay federal/state income taxes, Social Security, Medicare, etc.

Sales Tax - In many states, you must collect sales tax from customers on your goods/services and remit it regularly.

Estimated Taxes - No more waiting for employers to withhold. You'll likely need to pay estimated quarterly taxes.

Want to Stay Out of Tax Jail? Keep Flawless Records

Poor bookkeeping and sloppy financial records are a tiny business owner's worst nemesis. The key to smooth tax compliance?

Keep Pristine Records - Maintain organized books tracking all income, expenses, payroll, and deductions. Ditch the shoebox full of receipts!

Use Accounting Software - Platforms like QuickBooks, Xero, or FreshBooks can streamline everything.

Hire Backup - Work with an accountant (at least part-time) to ensure proper filings and payments.

Set Aside a Cash Cushion - Funnel money from each paid invoice into a dedicated tax savings account.

Be Punctual - Avoid interest and penalties by always filing and paying taxes on time!

This Isn't Free, I'll Owe a Fee!

In addition to state/federal taxes, make sure you've accounted for other fees:

Business licenses and permit renewals

Professional membership dues

Business insurance premiums

Don't let these recurring costs sneak up on you—budget for them from your very first year.

The government sure does take a hefty slice of the small business pie. But you know what? Following the rules and properly paying the tax man proves you're a legit, professional operation. It's worth it!

Section 9: Handling Legal Disputes and Litigation

Hey Buddy, Let's Talk About Lawsuits for a Sec

No small business owner starts their company dreaming of the day they get hit with a nice juicy lawsuit. But whether it's an intellectual property dispute, customer grievance, or disgruntled former employee, legal conflicts sometimes can't be avoided.

An Ounce of Lawsuit Prevention

As they say, an ounce of prevention is worth a pound of cure. Smart moves to keep legal issues at bay:

Airtight Contracts/Documentation - Meticulous paperwork prevents a "they said, they said" situation.

Proper Compliance - Follow all municipal codes, labor laws, accessibility standards, etc.

Happy Customers/Employees - Resolve internal issues and provide quality service.

But sometimes, even when you follow protocol, someone still gets litigious. Strap in.

Alternative Dispute Resolution for the Cooler-Headed

Wait to whip out the bazookas if a legal grenade gets lobbed at you. There are kinder, gentler resolution options:

Mediation - You and the other party privately negotiate with an impartial mediator to reach a resolution.

Arbitration - Like mediation, the arbitrator's decisions are legally binding on both sides.

Calm, reasoned discussions - Some conflicts can be resolved pragmatically before escalating legally.

Okay, So Maybe We're Going to Courthouse After All

Rational conflict resolution tactics sometimes don't work, and litigation is unavoidable. If you end up in full-blown lawsuit territory:

Have a Specialist on Standby - Vet and hire an experienced business attorney before you need one.

Don't Sleep on the Paperwork - Any relevant documentation/evidence is now ammunition.

Keep It Zipped - Don't speculate, vent, or openly discuss details that could torpedo your case.

Look Into Insurance - Commercial liability insurance may cover legal expenses/payouts.

Nobody wants a lawsuit, but with preparation and professional guidance, you can emerge relatively unscathed if necessary.

Section 10: Online Resources and Tools for Legal Assistance

Who Has Time for Law School? Get Legal Wisdom Online Instead

Hiring an actual attorney is the ultimate way to navigate complex legal situations. But for basic small business needs, the internet offers a bounty of resources to help you cover your bases without 24/7 access to a white-shoe law firm.

The Best Websites for SMB Legal Info

Whether you need to understand your obligations or create legal documents, these sites have your back:

Nolo.com - Comprehensive guides and tools for legally running a business.

RocketLawyer.com - This is an affordable way to access legal document templates and get quick advice.

LegalZoom.com - Step-by-step guidance for incorporation, trademarks, and other core needs.

AllBusiness.com - General resources, including articles and tips on legal/regulatory compliance.

Apps to Keep You Legit

These days, there is an app for everything - including managing the legal side of your business:

LegalShield - Get affordable legal counsel via this monthly subscription app.

DocuSign - No more dealing with paper trails and ink pens. Quickly sign and approve contracts digitally.

Biz Memos Lite - Capture key points and voice memos during meetings to ensure you have documentation.

Legal Dictionary - Decipher all that pesky legal jargon with this quick reference tool.

A Couple Caveats About DIY Legal Assistance

While self-education and apps are budget-friendly, they're no substitute for an experienced lawyer in high-stakes situations. Be cautious using them for:

Complex contracts with lots of custom terms and negotiations

Substantial lawsuits with significant financial implications

Tax and regulatory matters where errors can mean massive penalties

Don't be afraid to pay for professional legal services when they're mission-critical.

For the more straightforward stuff, use online tools!

FAQs - Legal Essentials for Small Business Owners

To wrap up, here are some common legal questions from small business owners:

1: Do I need to worry about getting permits and licenses for my small business?

In short, yes! Failure to acquire proper licenses and permits can lead to fines and even the termination of operations in extreme cases. Make sure your business is fully compliant right from the start.

2: What steps must I take to start an LLC or corporation?

You must file formation documents like Articles of Organization/Incorporation, apply for licenses/permits, get an EIN, register your business name, and draft an operating agreement. Each state has specific regulations, too.

3: How do I properly classify workers as employees or independent contractors?

It comes down to behavioral control, financial control, and the parties' relationship. IRS guidance looks at factors like hours/schedule, ability to work elsewhere, who provides tools/supplies, tax treatment, and intent of the working relationship.

4: Do I need a written contract with all my vendors, suppliers, and clients?

While not legally required, written contracts protect both parties and avoid messy disputes. They establish clear responsibilities, payment terms, ownership of work products, and more.

5: My side hustle is getting bigger - should I form a legal business entity?

Likely, especially if you want liability protection and plan to scale the business seriously. Speak to an attorney or tax professional about the best time and entity structure for your circumstances.

Additional Resources

Thank you for reading this article on legal essentials for small business owners. We recommend these additional articles related to legal issues.

Learn More>

Comments