When starting a new business, choosing the right business structure can be a challenge.

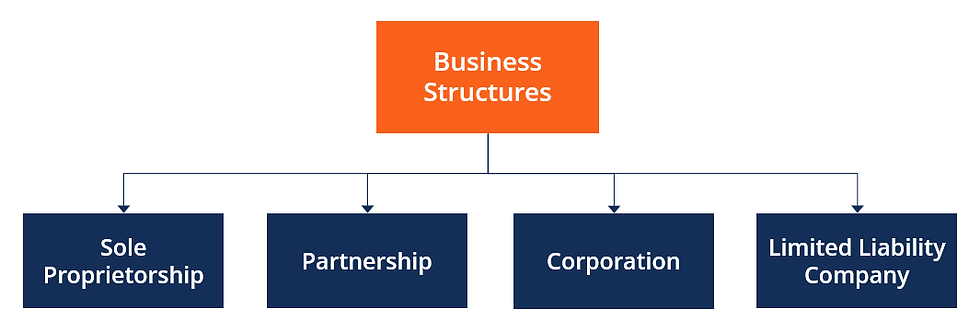

We will guide you through the four most common business structures: sole proprietorship, partnership, corporation, and limited liability company.

We will discuss the pros and cons of each business structure and provide you with the information you need to make an informed decision.

By the end of this post, you will better understand the various business structures and how to choose a business structure for your business.

Content>

What is a Business Structure?

A business structure, also known as a legal structure, refers to the legal organization of a business entity. It determines how a business operates, how it's taxed, and the level of liability exposure for the business owners.

There are several types of business structures, each with pros and cons.

Why is a Business Structure Important?

Selecting the appropriate business structure is crucial in starting a successful business venture. A business structure is essential for several reasons:

Legal Liability - The business structure determines the extent to which you, as an owner, are personally liable for the company's debts and obligations.

Tax Implications - Different business structures are taxed differently. Some involve pass-through taxation, while others may involve double taxation.

Investment Opportunities - Certain business structures are more attractive to investors. Corporations, for example, can issue shares of stock.

Business Continuity - Some structures have a perpetual existence. In contrast, some may end with the death or departure of an owner.

Credibility - A formal business structure can add credibility to your business.

Management Structure - The business structure can dictate how decisions are made and who makes them.

It's important to consider all these factors and consult a business advisor or attorney to make the best choice.

4 Most Common Business Structures?

The four most common business structures for those embarking on the entrepreneurial journey are sole proprietorship, partnership, corporation, and limited liability company.

Let's look at the pros and cons of each of these structures.

Sole proprietorship

A sole proprietorship is the simplest form of business structure. In 2023, there were 33 million sole proprietorships in the U.S.

It is owned and operated by one person, who controls all aspects of the business, including decision-making and profits.

However, they are personally liable for all the business's debts and legal responsibilities. The owner's assets could be at risk if the business incurs debts or is sued.

In a sole proprietorship, the business and the owner are considered the same entity for tax and liability purposes.

A sole proprietorship is relatively easy to set up but does not offer personal liability protection like other business structures, such as a corporation or limited liability company.

Pros:

Ease of Formation - Establishing a sole proprietorship is relatively easy, with minimal legal formalities and paperwork.

Control - The owner controls the business, including decision-making and operations.

Taxes - Tax reporting is straightforward, as business income and expenses are reported on the owner's tax return.

Cons:

Unlimited Liability - The owner is responsible for all business debts and obligations.

Limited Growth Potential - Sole proprietorships may face challenges accessing financing and expanding the business due to limited resources

Lack of Continuity - The business does not survive the owner, making it challenging to transfer ownership.

Partnership

A partnership is a business structure where two or more individuals operate the business together.

There are two main types of partnerships: general and limited partnerships.

In a general partnership, all partners share equally in the responsibility and liability of the business. They also share in the profits. Each partner is personally liable for the business's debts, and any partner can bind the entire business to a legal agreement.

There are general partners and limited partners in a limited partnership. General partners manage the business and assume liability for its debts.

The limited partners contribute capital and share profits but do not participate in the business's day-to-day operations. Limited partners' liability is limited to their investment in the business.

A partnership is relatively easy to set up but does not offer the same personal liability protection as other business structures, like a corporation or limited liability company.

Pros:

Shared Responsibility and Skills - Partners can combine their resources, expertise, and networks, enabling the business to benefit from diverse skill sets.

Ease of Formation - Establishing a partnership involves a partnership agreement but does not require extensive legal formalities.

Shared Tax Burden - The partnerships pass through profits and losses to individual partners, avoiding double taxation.

Cons:

Unlimited Liability - Partnerships have unlimited personal liability for business obligations like sole proprietorships.

Disagreements and Conflicts - Partnerships are prone to disputes over decision-making, profit-sharing, and responsibilities, which can strain relationships.

Limited Life Span - Partnerships dissolve upon the exit or death of a partner unless otherwise specified in the partnership agreement.

Learn More>

Corporation

A corporation is a more complex business structure that is considered a separate legal entity from its shareholders.

Since a corporation is a separate legal entity, the corporation itself, not the shareholders, holds all the business's liabilities. Therefore, shareholders are not personally responsible for the corporation's debts or legal issues; their liability is limited to the amount they've invested in the company.

Corporations are created by filing specific documents, typically called "articles of incorporation," with a state government. They are managed by a board of directors, which the shareholders elect. The board of directors makes high-level decisions for the corporation, while the day-to-day operations are handled by corporate officers (like the CEO, CFO, etc.).

One of the key advantages of a corporation is the ability to raise capital by selling shares of stock. The ability to raise capital can make it easier for corporations to grow and expand their operations. However, corporations are subject to more regulations and administrative requirements than sole proprietorships or partnerships.

For example, corporations must hold regular board meetings, keep detailed business records, and file separate corporate tax returns.

Different types of corporations, such as C and S corporations, are taxed differently. A C corporation is taxed separately from its owners.

In contrast, an S corporation allows profits and some losses to be passed through to the owners' income without being subject to corporate taxation.

In summary, while forming and maintaining a corporation can be more complex and costly than other business structures, it offers significant advantages in terms of liability protection and potential for growth.

Here are a corporation's pros and cons:

Pros:

Limited Liability - Shareholders' assets are protected from business liabilities, limiting personal risk.

Access to Capital - Corporations can quickly raise capital by issuing stocks and attracting investors.

Perpetual Existence - A corporation can continue to exist even if shareholders or management change.

Cons:

Complex Formation and Compliance - Establishing a corporation involves substantial legal requirements and ongoing compliance obligations, including annual reports, shareholder meetings, and record-keeping.

Double Taxation - Profits earned by the corporation are subject to corporate income tax, and dividends distributed to shareholders are taxed as personal income.

Loss of Control - Shareholders may have limited control over the business due to the separation of

Limited Liability Company

A Limited Liability Company, LLC, is a type of business structure combining corporate and partnership elements.

Like a corporation, an LLC provides its owners, known as members, with limited liability. Limited liability means the members are not personally responsible for the company's debts and liabilities.

In other words, if the LLC incurs debt or is sued, the member's assets, such as their homes or personal bank accounts, are typically protected. This limited liability is a significant advantage and is the feature from which the LLC gets its name.

However, an LLC is similar to a partnership in terms of flexibility and tax treatment. An LLC does not pay corporate taxes. Its profits and losses are "passed through" to each member, who then reports this information on their tax returns.

This is known as pass-through taxation and can help avoid the "double taxation" that can occur with some types of corporations, where both the corporation and the shareholders must pay taxes on the profits.

The management structure of an LLC is also flexible. Its members can manage it (member-managed) or managers selected by the members (manager-managed).

This allows the owners to choose the management structure that best suits their needs.

Setting up an LLC involves filing articles of organization with the state and paying a filing fee. Many LLCs also create an operating agreement, which outlines the operating procedures and ownership of the LLC.

In summary, an LLC is a popular choice for business owners who want the limited liability of a corporation but the tax advantages and flexibility of a partnership.

Pros:

Limited Liability - LLC owners' assets are protected from business debts and obligations like a corporation's.

Pass-through Taxation - LLCs can be taxed as a partnership, avoiding double taxation.

Flexibility - LLCs offer flexibility regarding management structure, profit distribution, and ownership. They allow customized operating agreements to suit the business's and its members' needs.

Cons:

Self-employment tax - The IRS treats LLCs as partnerships for tax reasons. Members working for the LLC are viewed as self-employed, which implies members are personally liable for paying self-employment tax.

Formalities and Compliance - While less burdensome than corporations, LLCs still have certain administrative requirements and ongoing compliance obligations, such as filing annual reports and maintaining proper records.

Member turnover - In some jurisdictions, unless otherwise specified in the operating agreement, the LLC may dissolve upon the departure or death of a member.

Learn More>

Comparing LLCs and S Corporations

LLCs and S corporations are two of the most popular business structures for small businesses because they provide liability protection and pass-through taxation.

However, there are some critical differences between the two entities:

Ownership - S corporations can only have up to 100 shareholders; all shareholders must be U.S. ciU.S.ns or residents. There are no such restrictions on LLC ownership.

Management Structure - LLCs can choose member-managed or manager-managed, providing flexibility. S corps require a formal board of directors and officers.

Tax Filing - LLCs file taxes as partnerships or sole proprietorships using personal tax returns. S corps file taxes separately using corporate tax returns.

Self-Employment Taxes - LLC members pay self-employment taxes on business profits. Only S Corp shareholders who are active in business management pay self-employment taxes.

Adding and Removing Owners - Adding or removing LLC members requires amending the operating agreement. S corps have more complex shareholder requirements.

State Compliance - Both entities must comply with state regulations. However, S corps have more extensive meeting and documentation requirements.

Converting Entity Types - LLCs can convert to S corps and vice versa with minimal complications.

In summary, LLCs offer more flexibility and fewer formalities, but S corps have some tax advantages.

Consult a business attorney and accountant to determine whether an LLC or S corporation better suits your business needs and plans.

Remember, the ideal structure may change as your business grows and evolves.

Learn More>

Other Common Business Structures

Nonprofits and franchises operate very differently from traditional for-profit business structures, such as sole proprietorships, partnerships, LLCs, and corporations.

Unlike those options, nonprofits focus on a social mission over profits, while franchises leverage an existing brand rather than building one from scratch.

Nonprofit

Unlike regular businesses designed to rake in profits, nonprofit organizations exist to fulfill some socially important purpose—to advance a worthy cause or provide some much-needed service to better the public good. They aim not to line the pockets of shareholders but to benefit communities.

The Pros

Tax Exemptions - Nonprofits can be exempt from paying taxes on donations and other revenue related to their do-gooding mission. This leaves them with more funds to plow into their good works.

Generous Donors - Philanthropic donors who give money to nonprofits can claim these donations as tax deductions. In this way, Uncle Sam indirectly helps support nonprofits.

Fundraising Credibility - A nonprofit status affords an organization more credibility when running campaigns to raise charitable contributions from everyday folks or grants from foundations. This funding keeps them running.

The Cons

Capital Shortages - Raising funds for a new facility, major equipment purchases, or other big-ticket expenses can be trickier for nonprofits than for regular businesses.

Administrative Duties - To maintain that coveted tax-exempt status, nonprofits must comply with record-keeping, reporting, and oversight requirements. This sucks up time better spent helping people.

Uncertain Finances - Reliance on the whims of donor generosity and fluctuating grant budgets can make it challenging to predict budgets accurately from one year to the next.

The Bottom Line

While the tax breaks and fundraising advantages help keep them afloat, nonprofits take on an invaluable role in serving communities above making profits. But that also makes for less certain finances and more red tape. For those dedicated to mission over money, it's a tradeoff worth making.

Franchise

A franchise is a business model that allows an independent operator to license a business's trademarks, products, services, and entire brand identity in exchange for an upfront fee and ongoing royalty payments.

Some of the defining features of a franchise structure include:

Pros:

Established Brand and Systems: Franchisees benefit from an existing brand, reputation, and customer base right out of the gate. The franchisor also provides training, site selection, marketing plans, operating procedures, and ongoing support.

Access to Financing: Banks are often more willing to lend money to franchise locations than independent startups due to the proven franchise model.

Ongoing Support: Franchisors are vested in franchisees' success and assist with marketing, operations, purchasing, and more.

Cons:

High Upfront Costs: The franchise fee and setup costs to launch a franchise can reach six figures, requiring substantial upfront capital.

Less Autonomy: Franchisees must adhere to the franchisor's systems and brand standards, limiting flexibility.

Ongoing Royalties: Franchisees pay a percentage of sales revenue as a royalty to the franchisor, reducing profitability.

For entrepreneurs interested in running an established operation with extensive support, franchising provides benefits over starting a small business from scratch.

However, the costs and brand restrictions require consideration.

Criteria to Consider

Before starting a business and selecting a structure, it's crucial to consider factors such as liability, tax implications, investment needs, and control.

Here are some criteria you should consider when choosing a business structure:

Liability – If your business involves some risk, you may want to consider a business structure that protects your assets.

Tax implications – Different structures have different tax consequences.

Investment needs – Your ability to raise future funds may be impacted by the type of business structure you select.

Control and complexity – Some business structures are easier to set up, and control remains with the owner. Other structures are more formal and may involve a board of directors.

Remember, it's always a good idea to consult with your legal and financial advisors to understand the implications of each business structure.

Changing Your Business Structure

It would be best to consider changing your business structure as it grows.

Before changing structures, consider a change's potential legal and tax implications.

With the right legal and financial advisors, you can change your business structure with some paperwork and patience. With proper planning, the conversion process can go smoothly.

Consider whether you need an updated ownership agreement, updated shares, and other internal documents.

Remember to notify your vendors, customers, credit card companies, and other partners about the change in your legal structure.

Conclusion

Whether you're just beginning your entrepreneurial journey or re-evaluating your existing structure, it's essential to weigh the pros and cons of each carefully.

Sole proprietorships and partnerships are simple to form but come with limited liability.

Corporations provide limited liability but have more complex formation and compliance requirements.

LLCs offer limited liability and are less complex to form than a corporation.

Consult with your legal and accounting advisors to ensure that you understand the business structure you are considering.

Additional Resources

Thank you for reading this article on Choosing the Right Business Structure. We recommend these additional articles related to starting a business.

Learn More>

Comments